Annual Enrollment provides an opportunity to review and change your benefits for the following calendar year.

Annual Enrollment for faculty, staff and retirees is October 27 to November 7, 2025.

Jump to: Annual Enrollment for Faculty and Staff or Annual Enrollment for Retirees.

Annual Enrollment for Faculty and Staff

If you do not wish to make changes to your elections, no action is required on your part. The benefit elections you made in 2025 will continue into 2026, with the exception of:

- The Tiered PPO Plan is being replaced with a Kansas City Core Network and Rolla Surest plan options. Employees on the Tiered PPO Plan will need to select a new plan or will be auto enrolled in the PPO Plan.

- The Custom Network Plan for St. Louis participants is being replaced with a St. Louis Core Network Plan. Employees on the Custom Network Plan for St. Louis will need to select a new plan or will be auto enrolled in the St. Louis Core Network Plan.

- Flexible Spending Accounts (FSA) require re-enrollment each year.

Click on a header to expand the selection and uncover additional information about Annual Enrollment.

1. See what is new (plan changes for 2026)

- New medical plan options: New Core Network plans in Kansas City and St. Louis and Surest Plan in Rolla.

- The Tiered PPO Plan is being replaced with a Kansas City Core Network and Rolla Surest plan options. Employees on the Tiered PPO Plan will need to select a new plan or will be auto enrolled in the PPO Plan.

- The Custom Network Plan for St. Louis participants is being replaced with a St. Louis Core Network Plan. Employees on the Custom Network Plan for St. Louis will need to select a new plan or will be auto enrolled in the St. Louis Core Network Plan.

- Annual contribution limits increased for Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA).

- Health Savings Account (HSA) vendor will transition from Optum to Fidelity.

- New Health Payment Account (HPA) benefit available through Paytient for Healthy Savings Plan participants.

- Medical plan increases from $6 - $78.

- Deductible, copay and/or coinsurance changes across all medical plans.

- Increases in the Dental Plan and Short-Term Disability Buy-Up Plan.

- Specialty prescriptions will be managed and processed through ArchimedesRx.

2. Research your plan options (compare insurance plans and options)

Review plan information

Review your current benefit plan elections in myHR, including enrolled dependents and designated beneficiaries. Visit the webpage for each plan to see detailed information about coverage available across a range of health programs (medical, dental, vision), disability and life insurances and tax-favored accounts (HSA and FSA).

|

The researching insurance options webpage has additional tips and resources for finding the plans that are right for you. |

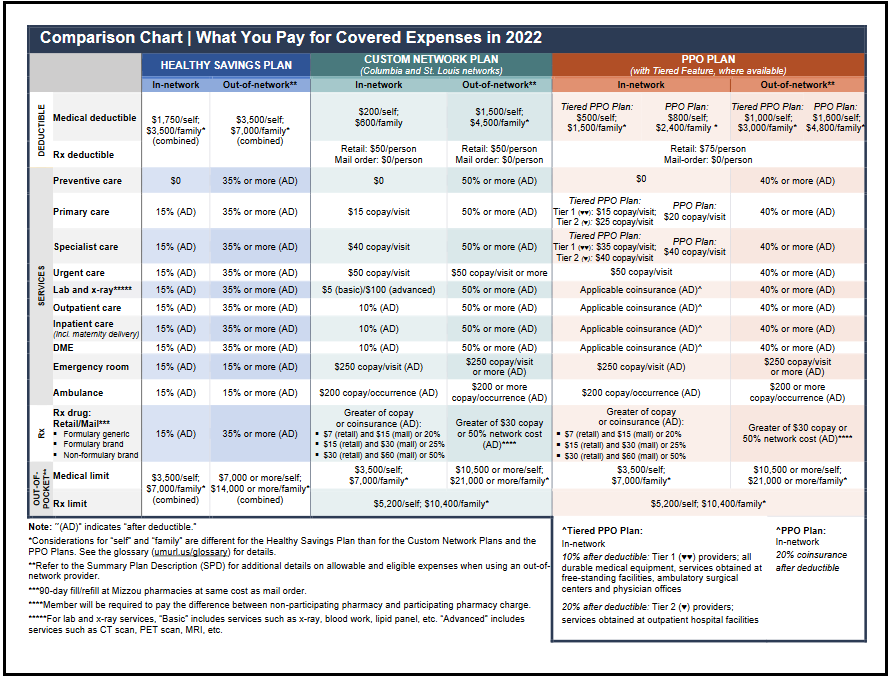

Check out the Plan Information and Comparison handout (343KB, PDF), which features a printable comparison chart and premium rates for the available insurance plans.

|

Attend an Informational Meeting

Attend an Annual Enrollment virtual meeting in your location to get information about your benefits options. View the full schedule on the Annual Enrollment informational meetings to find the session that works best for you.

Reach out to your HR Generalist

You can book a one-on-one appointment with your campus HR Generalist to get personalized assistance for all your insurance and enrollment questions.

For additional assistance, contact the HR Service Center by:

- Via phone at (573) 882-2146 or toll-free (800) 488-5288.

- Via email at hrservicecenter@umsystem.edu.

3. Enroll in myHR (select and submit the plans that are right for you)

Once you have decided which insurance plans are best for you, enroll by logging into myHR (myhr.umsystem.edu) ("My Benefits" tile > "Benefits Enrollment"). For more detailed instructions and tutorials for using myHR, visit the researching insurance options webpage or myHR Training webpage.

You are not done with your enrollment until you click both the “Submit” button as well as the “Done” button on the pop-up screen. An email confirmation will be sent to your university email account so you know your submission was received.

A few reminders

- FSA continuation: If you would like to contribute to a Health Care or Dependent Care Flexible Spending Account (FSA), you must re-enroll each year.

- 2025 FSA to 2026 HSA: If you are switching from an FSA to a Health Savings Account (HSA), your 2025 FSA must have a zero balance by December 31, 2025. If not, contributions to your HSA will be delayed until April 1, 2026.

- Confirm address in myHR: Make sure your contact information is up to date in myHR (myHR.umsystem.edu).

4. After you enroll (ID cards and types of care)

Watch the mail for important documents

- New ID cards: Make sure you show your provider your new card(s) at the time of service; benefits are effective even if you have not received your cards yet.

- Medical/Prescription: For 2026 coverage, you will receive a new single card for medical and prescription coverage if you are newly enrolled, have changed plans or continue enrollment in the Custom Network or Healthy Savings Plan. If you have elected paperless communications from UHC, you will receive a digital insurance card in lieu of a physical card. Physical cards can be mailed by request without changing your paperless preferences.

- Dental: You will receive an ID card (in the subscriber’s name) only if you are newly enrolled.

- Vision: No card is issued.

Make the most of your health insurance

Preventive services let you take charge of your health and stop problems before they start. If you enroll in medical insurance, in-network preventive care is covered at 100%. Preventive care includes annual physical exams, immunizations and well-child care unrelated to a medical diagnosis. A list of what is considered preventive under Health Care Reform/ACA is available on healthcare.gov or UHC's preventive care website.

With vision insurance, annual eye exams are offered with a small copay. Generally speaking, if you are enrolling in the dental plan, routine oral exams are covered completely, but it is always a good idea to check with your provider. Contact information for all insurance administrators is available on the Plan Contacts webpage.

Choose the right type of care

Making an informed decision about your health care needs can save you time and money, but when you are ill or injured, assessing your condition and choosing the best place to go for treatment is not easy. You have many care options, but each is unique in the services it provides. Check out UHC's Where to go for Care flyer (PDF) for additional information.

Virtual visits

UnitedHealthcare virtual visits, also referred to as virtual care services, let you see and talk to a doctor by phone or video from your mobile device or computer without an appointment, any time. Virtual visits are a great option for when your doctor is not available, if you get sick while traveling or if you are considering visiting a hospital emergency room for a non-emergency health condition. Visit the Virtual Visits webpage for additional information.

5. Make the most of other benefits (tuition assistance, EAP and other programs)

The UM System offers benefits that extend well beyond your insurance options and focus on helping you further your education and support the personal health and well-being for you, your family, your friends and your community.

Tuition Assistance

If you meet educational assistance eligibility requirements, 75% of tuition and supplemental fees can be waived for college-level credit courses up to the allotted course limit (per semester). After you have one year of continuous full-time service in a fully benefit-eligible position, your spouse and/or dependent may also be eligible to receive a 50% tuition reduction for UM System college-level credit courses up to the allotted limit. Visit the Tuition Assistance webpage to learn more.

You must submit an enrollment form every semester that you want assistance by the required deadline:

- Fall semester- October 1

- Spring semester- March 1

- Summer semester- July 1

A new system will launch in late fall for all tuition assistance applications for the Spring 2026 semester and beyond.

If you are a veteran of the U.S. Armed Forces, consult your campus veteran services office to learn more about special programs and tuition benefits available only to veterans.

Employee Assistance Program

The Employee Assistance Program (EAP), provided by Optum’s Live and Work Well program, offers emotional wellbeing solutions for employees (faculty and staff) and their household members such as:

- Unlimited telephonic access to master’s-level clinicians (24/7)

- Three (3) free counseling sessions per presenting issue

- An online platform offering self-directed access to tools and resources to support emotional wellness.

Through the EAP, University of Missouri employees and their household members can also receive free premium access to the Calm app. Calm is designed to help you stress less and feel better. Get meditations, breathing exercises, sleep stories, daily tips and more. Visit the Employee Assistance Program (EAP) webpage to learn more.

Flu Vaccine and Health Screenings

On-campus flu vaccine clinics are available for faculty, staff and dependents (children 7 years and older accompanied by parent/guardian) enrolled in a university medical insurance plan. Appointments are required and can be made through the scheduling portal. Visit the Flu vaccine and health screenings webpage for additional information.

If you are enrolled in a university medical insurance plan, you may also obtain a free flu vaccine at an in-network pharmacy or medical provider. Consult UHC’s location list. Please note, MU Health Care employees will receive a free vaccination from their Staff Health office.

Annual Enrollment for Retirees

Retirees and their dependents have different medical insurance options than active employees. If you are satisfied with your current enrollments and would like to continue the same coverage in 2026, no action is required on your part. You and your covered dependents will be enrolled in the same plans you have now. Changes for 2026 must be submitted by November 7, 2025.

Click on a header to expand the selection and uncover additional information about Retiree Annual Enrollment.

Retirees: Prepare for Annual Enrollment

To get ready for Annual Enrollment:

- Update your mailing address to ensure you receive timely communications.

- Please review and update your home and mailing addresses in myHR.

- See the myHR Training webpage to view the Retiree Training Guide for instructions on making updates in myHR.

- If necessary, contact the HR Service Center to request a form to update your address.

- Please review and update your home and mailing addresses in myHR.

- Review the retiree benefits overview.

- Attend an informational session to learn about benefits plans and changes for 2026 (full schedule below).

- Find a provider among a full list of plan contacts.

Retirees: Learn more about the plans available

If you have not received your personalized Annual Enrollment letter by October 10, 2025, contact the HR Service Center.

Learn about UM-sponsored plans

- UM-sponsored UnitedHealthcare® Group Medicare Advantage Base (13796) and Enhanced (13797) Plans

- View the most current plan benefit information on the UnitedHealthcare coverage for UM System Retirees website.

- Retiree Health PPO Plan and Retiree Healthy Savings Plan

- View the most current plan benefit information on the Retiree benefits overview webpage.

Have questions?

Contact the HR Service Center. For questions about the Medicare Advantage Base Plan or Enhanced Plan, call the UnitedHealthcare call center at 1-866-899-5903, TTY 711. The call center is available from 8:00 a.m. – 8:00 p.m. all time zones, Monday – Friday.

Retirees: Attend an informational session

Online and call-in sessions

The UnitedHealthcare Information Sessions provide a general overview of all retiree medical plan changes in 2026 for both non-Medicare and Medicare-eligible members. All retirees and their dependents enrolled in a medical plan are invited to participate, regardless of Medicare status. All session times will have the same presentation and no registration is required.

Medicare eligible retirees and dependents are encouraged to attend an informational session to learn more about the 2026 changes.

Specific questions regarding retiree benefit premiums and non-medical plans will not be addressed in the UnitedHealthcare informational sessions. These individual questions should be referred to the HR Service Center for assistance.

| Date | Time | Type of Session | Access Information |

|---|---|---|---|

| October 16, 2025 | 10:00 – 11:30 a.m. CST | Webex (call in or view online) |

Access the meeting via Webex Call in for audio only: 763-957-6400 |

| October 16, 2025 | 2:00 – 3:30 p.m. CST | Teleconference (call in only) | Call in: 888-606-9807 Access code: 1948510 |

| October 22, 2025 | 10:00 – 11:30 a.m. CST | Teleconference (call in only) | Call in: 888-606-9807 Access code: 1948510 |

| October 22, 2025 | 2:00 – 3:30 p.m. CST | Webex (call in or view online) |

Access the meeting via Webex Call in for audio only: 763-957-6400 |

Retiree Health Benefits Virtual Town Hall

Oct. 15, 2025, 10 -11:30 a.m.

See detailed event page for access information

This event is hosted in cooperation with the four UM System campus retiree associations and focuses on health insurance benefits for retirees during the 2026 calendar year. UM System benefits experts and representatives from UnitedHealthcare will provide an overview of the retiree medical plans, dental and vision as well as changes for 2026

Retirees: Change elections for 2026

Make changes during Annual Enrollment

Annual Enrollment for retirees ends November 7, 2025.

To change medical or dental plans and/or change, cancel or add the vision plan for yourself and your dependents, complete the 2026 Annual Enrollment Retiree Benefits Change Form. Additionally, use this form to make changes to all retiree benefit plan options with an effective date of January 1, 2026. If coverage is reduced or cancelled, it cannot be reinstated at a later date.

Make changes outside Annual Enrollment

To reduce or cancel coverage in all plans, except vision, complete a Retiree Benefits Change Form. Please note, if coverage is reduced or cancelled, it cannot be reinstated at a later date. Vision insurance may only be changed (elected, reduced or canceled) during Annual Enrollment.

- Retiree Benefits Change Form (PDF, 827KB)

Reviewed 2025-09-24