Overview

The UM System supports employees and their families who choose to continue their education. Faculty and staff who choose to pursue or continue their college education—as well as eligible spouses and dependents—can receive assistance at any of the universities within the UM System.

Policies

For full details of the policies governing tuition assistance, please review the following:

- Collected Rules and Regulations, Section 230.070: Educational Assistance Program for University Employees

- HR-303 Educational Assistance and Tuition Reduction Program for University Employees and Their Spouses/Dependents (Prior to Fall 2023)

- HR-303 Educational Assistance and Tuition Reduction Program for University Employees and Their Spouses/Dependents (As of Fall 2023)

- HR Policy Manual, HR-303- Educational Assistance and Tuition Reduction Program for University Employees and Their Spouse/Dependents Q&As

Amount of assistance

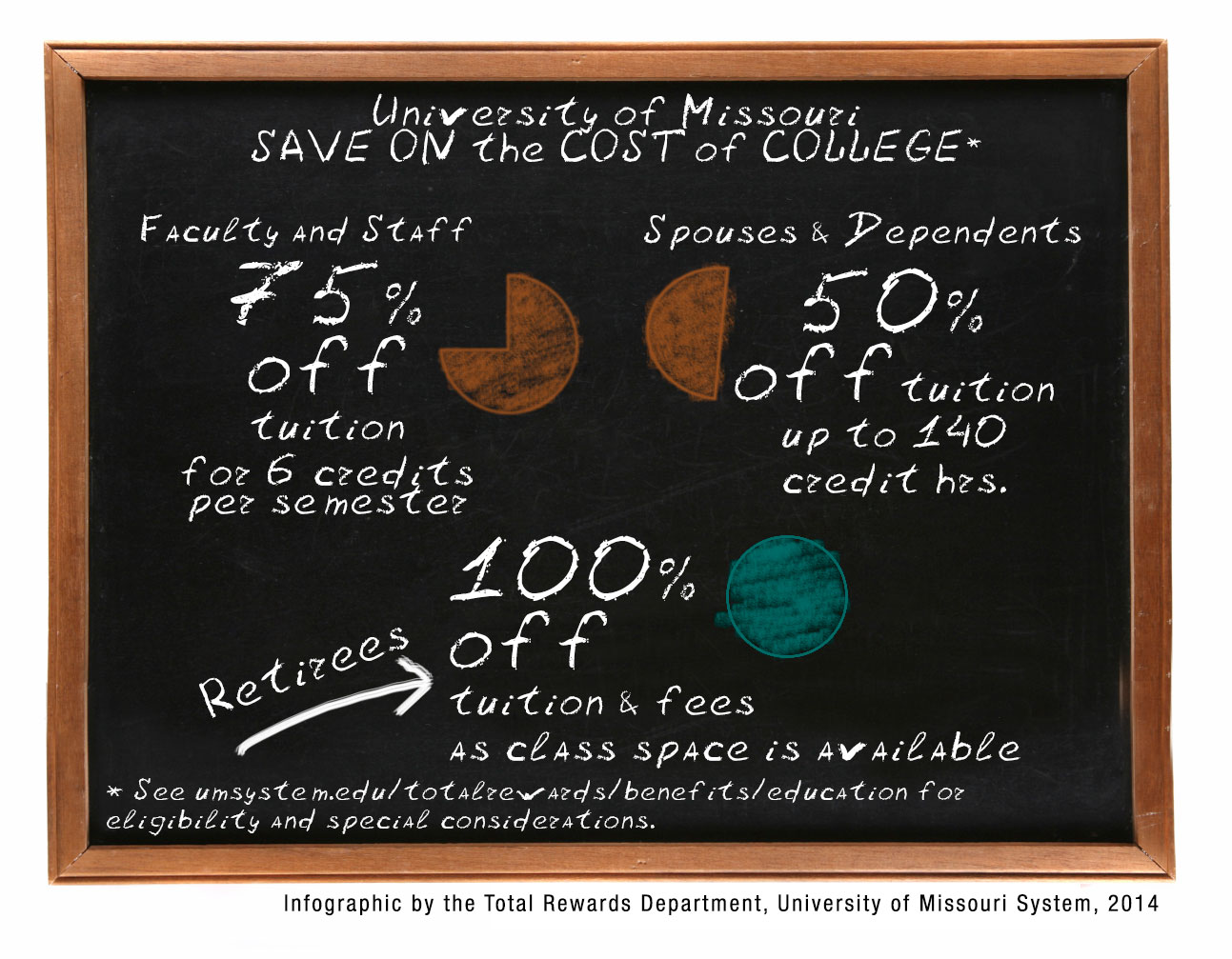

How much you receive for educational/tuition assistance depends on who you are.

If you are an eligible employee (defined in the next section), 75% of your tuition and supplemental fees can be waived for college-level credit courses. This 75-percent reduction applies to up to six credit hours per semester, except for the summer session when you may receive the same reduction for up to three credit hours.

The full 100 percent of tuition and supplemental fees are waived if an employee audits courses on their own, or at the request of the department head.

Veterans of the U.S. Armed Forces should consult the veteran services office on your campus to learn more about special programs and tuition benefits available only to veterans.

Educational Assistance and Tuition Reduction benefits may be taxable; see provision II.D in the following for additional details:

Provided class space is available, 100 percent of your tuition, supplemental fees and student activity fees can be waived if you are a retiree who was considered an eligible employee before you retired. The waiver is available for any college-level credit courses. Books and other expenses and costs must be paid by the retiree.

Educational Assistance and Tuition Reduction benefits may be taxable; see provision II.D in the following for additional details:

The University provides a 50-percent reduction in tuition for eligible spouses and dependents of employees who have accrued at least one year of continuous, full-time service with the University prior to the deadline for regular registration. This reduction is available for up to 140 hour of college-credit courses at a UM System institution.2 Only tuition is reduced under this program. Activity fees, late fees, books and other expenses are the responsibility of the student.

Educational Assistance and Tuition Reduction benefits may be taxable; see provision II.D in the following for additional details:

Eligibility

Only some people qualify for educational/tuition assistance.

You are eligible for a 75-percent reduction in tuition and fees if you are one of the following:

- A benefit-eligible employee who:

- is Administrative, Service and Support staff;

- has passed the probationary period prior to the deadline for regular registration. Immediately prior to regular registration, the employee must have completed a six-month period of continuous employment; and

- remains a University of Missouri System employee through the beginning of the course(s) in which enrolled.3

- A benefit-eligible academic employee.

You are not eligible if you are a student or employee in a position considered to be student employment (including, but not limited to, graduate teaching assistants, graduate research assistants, graduate instructors and student assistants).

You are eligible for a 100-percent reduction in tuition and fees if you are a retiree who fell into one of the two categories of eligible employees when you were in active service—i.e., if you were a regular employee or fully benefit-eligible academic as described in the previous section.

A spouse or dependent is eligible for a reduction of 50 percent of tuition if the employee to whom they are related is:

- currently employed as an eligible employee, as described above,

- has accumulated at least one year of continuous, full-time service with the University at some point, and

- employed with the University immediately prior to the deadline for regular registration.

Spouses and dependents receiving tuition reduction benefits at the time of a sponsoring employee’s death will continue to receive those benefits for up to 140 credit hours. Similarly, if a sponsoring employee chooses to retire while a spouse or dependent is receiving reduced tuition, the benefit will continue beyond the sponsoring employee’s retirement up to 140 credit hours. In the event of a sponsoring employee’s death or retirement, a spouse or dependent’s educational assistance benefits will last no longer than five years after that death or retirement.

See the "how to enroll" box below for special instructions when seeking spousal/dependent tuition assistance for the first time.

Consult the HR Manual (Policy HR-303) for specifics on who qualifies as a “spouse” and as a “dependent.”

How to enroll

- Complete an application for admission and get accepted to the classes you want to take.

- Complete the Educational Assistance and Tuition Reduction Form, available in the HR Request Portal (you will need to log in with your University ID and password).

- You have to submit a new form for each student enrolling–and you have to complete the form each and every semester that you want assistance.

- You must request assistance by the following deadlines, depending on the semester or session for which you’re requesting assistance. You can’t get assistance after the semester/session ends.4

- Fall semester (includes fall intersession)- October 1

- Spring semester (includes winter intersession)- March 1

- Summer semester (includes summer intersession)- July 1

- Follow the instructions on the form itself for submitting it and getting approval.

- You must request assistance by the following deadlines, depending on the semester or session for which you’re requesting assistance. You can’t get assistance after the semester/session ends.4

- If you are seeking tuition assistance for a spouse/dependent for the first time, please be aware that proof of relationship will be required. Visit the forms and guides list for educational/tuition assistance to access the proof of relationship requirements for children, spouses, and Sponsored Adult Dependents, as well as the Sponsored Adult Dependent form should you need it. Or contact the HR Service Center or your HR Generalist to find out if proof of relationship is already on file with the Office of Human Resources.

Reviewed 2023-08-25